Oil price over $147 for the first time-now above $80

Moderator: S2k Moderators

- HURAKAN

- Professional-Met

- Posts: 46086

- Age: 38

- Joined: Thu May 20, 2004 4:34 pm

- Location: Key West, FL

- Contact:

Re: Oil price over $105 for the first time

Oil Falls After Setting Record

By JOHN WILEN – 1 day ago

NEW YORK (AP) — Oil prices jumped to a new record above $106 Friday but settled lower, extending their recent pattern of choppy trading after a weak jobs report convinced many traders that the Federal Reserve's interest rate cutting campaign will continue.

Employers cut 63,000 jobs in February, the biggest drop in five years, the Labor Department said. Investors can react to such news in one of two ways: by selling on the prospect that the economy, and demand for oil, is cooling, or by buying on a conviction that bad economic data makes it more likely the Fed will cut rates.

On Friday, investors engaged in a little of both, sending oil prices down more than a dollar at one moment, and propelling them to new records the next.

"The higher the market goes, the more volatile it becomes," said Darin Newsom, senior analyst at DTN in Omaha, Neb. "Does it mean that the rally is over? No."

Light, sweet crude for April delivery fell 32 cents to settle at $105.15 a barrel on the New York Mercantile Exchange. But prices fluctuated widely, setting a new trading record of $106.54 and falling as low as $103.91.

At the pump, meanwhile, gas prices extended their march toward new records, rising 0.4 cent to a national average of $3.189 a gallon, according to AAA and the Oil Price Information Service. Gas prices are 68 cents higher than a year ago, and within a nickel of last May's record price of $3.227 a gallon. Many analysts expect prices to jump much higher as driving demand picks up in the spring.

Lower interest rates tend to weaken the dollar, and many analysts believe the weak dollar is the reason why oil set new inflation-adjusted records four times this week, and has risen 23 percent in less than a month.

Crude futures offer a hedge against a falling dollar, and oil futures bought and sold in dollars are more attractive to foreign investors when the dollar is falling. On Friday, the dollar set a new low against the euro Friday before rising. But most investors believe that despite occasional rebounds, the dollar is likely to continue falling as the Fed continues to cut rates.

"The swings in the dollar are still the most critical item," said Jim Ritterbusch, president of Ritterbusch and Associates, an energy consultancy in Galena, Ill.

Concerns about a possible conflict between oil producers Venezuela and Colombia also supported oil prices Friday. Earlier this week, rebels attacked and shut down a a Colombian oil pipeline that transports 60,000 barrels of oil a day in retaliation for a Colombian raid into Ecuador. Venezuela threatened to slash trade and nationalize Colombian-owned businesses, and Venezuela and Ecuador have sent troops to their borders with Colombia.

Many analysts believe oil is overvalued, arguing that oil supplies are at high levels and the demand is falling. In its latest inventory report, the Energy Department said overall demand for oil dropped 3.4 percent over the last four weeks compared to the same period last year.

"We don't see oil demand accelerating while the price has its foot on the throat of consumers," said Tim Evans, an analyst at Citigroup Inc., in a research note.

But while analysts expect oil's underlying supply and demand fundamentals to eventually pull down its price, few are willing to predict when that will happen. Meanwhile, oil could continue rising to as high as $120 in the short term, according to some forecasts.

Goldman Sachs, a widely watched oil price prognosticator, said oil could average $110 a barrel by 2010, up from a previous forecast of $80, and said a price spike as high as $200 a barrel is possible, according to Dow Jones Newswires.

Other energy futures were mixed Friday. April gasoline futures rose 4.11 cents to settle at $2.6943 a gallon, while April heating oil futures fell 2.63 cents to settle at $2.947 a gallon after earlier hitting a new trading record of $2.9863 a gallon.

April natural gas futures rose 2.7 cents to settle at $9.769 per 1,000 cubic feet.

In London, April Brent crude fell 23 cents to settle at $102.38 a barrel on the ICE Futures exchange.

Associated Press writers Pablo Gorondi in Budapest and Gillian Wong in Singapore contributed to this report.

By JOHN WILEN – 1 day ago

NEW YORK (AP) — Oil prices jumped to a new record above $106 Friday but settled lower, extending their recent pattern of choppy trading after a weak jobs report convinced many traders that the Federal Reserve's interest rate cutting campaign will continue.

Employers cut 63,000 jobs in February, the biggest drop in five years, the Labor Department said. Investors can react to such news in one of two ways: by selling on the prospect that the economy, and demand for oil, is cooling, or by buying on a conviction that bad economic data makes it more likely the Fed will cut rates.

On Friday, investors engaged in a little of both, sending oil prices down more than a dollar at one moment, and propelling them to new records the next.

"The higher the market goes, the more volatile it becomes," said Darin Newsom, senior analyst at DTN in Omaha, Neb. "Does it mean that the rally is over? No."

Light, sweet crude for April delivery fell 32 cents to settle at $105.15 a barrel on the New York Mercantile Exchange. But prices fluctuated widely, setting a new trading record of $106.54 and falling as low as $103.91.

At the pump, meanwhile, gas prices extended their march toward new records, rising 0.4 cent to a national average of $3.189 a gallon, according to AAA and the Oil Price Information Service. Gas prices are 68 cents higher than a year ago, and within a nickel of last May's record price of $3.227 a gallon. Many analysts expect prices to jump much higher as driving demand picks up in the spring.

Lower interest rates tend to weaken the dollar, and many analysts believe the weak dollar is the reason why oil set new inflation-adjusted records four times this week, and has risen 23 percent in less than a month.

Crude futures offer a hedge against a falling dollar, and oil futures bought and sold in dollars are more attractive to foreign investors when the dollar is falling. On Friday, the dollar set a new low against the euro Friday before rising. But most investors believe that despite occasional rebounds, the dollar is likely to continue falling as the Fed continues to cut rates.

"The swings in the dollar are still the most critical item," said Jim Ritterbusch, president of Ritterbusch and Associates, an energy consultancy in Galena, Ill.

Concerns about a possible conflict between oil producers Venezuela and Colombia also supported oil prices Friday. Earlier this week, rebels attacked and shut down a a Colombian oil pipeline that transports 60,000 barrels of oil a day in retaliation for a Colombian raid into Ecuador. Venezuela threatened to slash trade and nationalize Colombian-owned businesses, and Venezuela and Ecuador have sent troops to their borders with Colombia.

Many analysts believe oil is overvalued, arguing that oil supplies are at high levels and the demand is falling. In its latest inventory report, the Energy Department said overall demand for oil dropped 3.4 percent over the last four weeks compared to the same period last year.

"We don't see oil demand accelerating while the price has its foot on the throat of consumers," said Tim Evans, an analyst at Citigroup Inc., in a research note.

But while analysts expect oil's underlying supply and demand fundamentals to eventually pull down its price, few are willing to predict when that will happen. Meanwhile, oil could continue rising to as high as $120 in the short term, according to some forecasts.

Goldman Sachs, a widely watched oil price prognosticator, said oil could average $110 a barrel by 2010, up from a previous forecast of $80, and said a price spike as high as $200 a barrel is possible, according to Dow Jones Newswires.

Other energy futures were mixed Friday. April gasoline futures rose 4.11 cents to settle at $2.6943 a gallon, while April heating oil futures fell 2.63 cents to settle at $2.947 a gallon after earlier hitting a new trading record of $2.9863 a gallon.

April natural gas futures rose 2.7 cents to settle at $9.769 per 1,000 cubic feet.

In London, April Brent crude fell 23 cents to settle at $102.38 a barrel on the ICE Futures exchange.

Associated Press writers Pablo Gorondi in Budapest and Gillian Wong in Singapore contributed to this report.

0 likes

- HURAKAN

- Professional-Met

- Posts: 46086

- Age: 38

- Joined: Thu May 20, 2004 4:34 pm

- Location: Key West, FL

- Contact:

Re: Oil price over $106 for the first time

Oil Declines as Tensions Ease in Venezuela, Mexico Opens Ports

By Grant Smith

March 10 (Bloomberg) -- Crude oil fell after Venezuela recalled troops from its Colombian border, allaying concerns of a regional conflict. Mexico opened oil ports shut by weather.

Venezuela, the fifth-biggest supplier in the Organization of Petroleum Exporting Countries, had dispatched 10 armored battalions on March 2 after Colombia struck a guerilla leader based in Ecuador. Petroleos Mexicanos, the state-owned oil company, reopened terminals in the Gulf of Mexico after closing them on March 7 because of heavy rain and winds.

``We're seeing the fall out between Ecuador, Venezuela and Colombia healed as a temporary truce emerges, while it's also likely shipments from Mexico will resume later today,'' said Rob Laughlin, senior broker at MF Global Ltd. in London. ``This is happening against the bigger picture of the ailing U.S. economy, where recession fears continue to mount.''

Crude oil for April delivery fell as much as 73 cents, or 0.7 percent, to $104.42 a barrel in electronic trading on the New York Mercantile Exchange. The contract traded at $104.52 a barrel at 10:07 a.m. London time.

On March 7, the contract rose to a record $106.54 a barrel before settling at $105.15 a barrel. Prices have gained 78 percent in the past year.

The border tensions, which led Venezuela and Ecuador to break diplomatic relations with Colombia, raised concerns of a regional war among the three oil-exporting countries. That helped push oil prices to a record $106.54 a barrel March 7.

Brent Oil

Brent crude oil for April settlement fell as much as 77 cents, or 0.8 percent, to $101.61 a barrel on London's ICE Futures Europe exchange. The contract traded $101.69 at 10:05 a.m. in London. The contract fell on March 7 by 23 cents to close at $102.38 after earlier reaching a record $103.98 a barrel.

A Labor Department report on March 7 report showed the U.S. shed jobs last month, signaling demand may slow in the world's biggest energy-consuming country. The U.S. unexpectedly lost 63,000 jobs in February, the biggest drop since March 2003.

``The jobless report wasn't favorable,'' said David Aleman, a senior trader at Grand Central Trading Co. in Newport Beach, California. ``We're in uncharted territory and we are trading cautiously given there's a glut of oil.''

By Grant Smith

March 10 (Bloomberg) -- Crude oil fell after Venezuela recalled troops from its Colombian border, allaying concerns of a regional conflict. Mexico opened oil ports shut by weather.

Venezuela, the fifth-biggest supplier in the Organization of Petroleum Exporting Countries, had dispatched 10 armored battalions on March 2 after Colombia struck a guerilla leader based in Ecuador. Petroleos Mexicanos, the state-owned oil company, reopened terminals in the Gulf of Mexico after closing them on March 7 because of heavy rain and winds.

``We're seeing the fall out between Ecuador, Venezuela and Colombia healed as a temporary truce emerges, while it's also likely shipments from Mexico will resume later today,'' said Rob Laughlin, senior broker at MF Global Ltd. in London. ``This is happening against the bigger picture of the ailing U.S. economy, where recession fears continue to mount.''

Crude oil for April delivery fell as much as 73 cents, or 0.7 percent, to $104.42 a barrel in electronic trading on the New York Mercantile Exchange. The contract traded at $104.52 a barrel at 10:07 a.m. London time.

On March 7, the contract rose to a record $106.54 a barrel before settling at $105.15 a barrel. Prices have gained 78 percent in the past year.

The border tensions, which led Venezuela and Ecuador to break diplomatic relations with Colombia, raised concerns of a regional war among the three oil-exporting countries. That helped push oil prices to a record $106.54 a barrel March 7.

Brent Oil

Brent crude oil for April settlement fell as much as 77 cents, or 0.8 percent, to $101.61 a barrel on London's ICE Futures Europe exchange. The contract traded $101.69 at 10:05 a.m. in London. The contract fell on March 7 by 23 cents to close at $102.38 after earlier reaching a record $103.98 a barrel.

A Labor Department report on March 7 report showed the U.S. shed jobs last month, signaling demand may slow in the world's biggest energy-consuming country. The U.S. unexpectedly lost 63,000 jobs in February, the biggest drop since March 2003.

``The jobless report wasn't favorable,'' said David Aleman, a senior trader at Grand Central Trading Co. in Newport Beach, California. ``We're in uncharted territory and we are trading cautiously given there's a glut of oil.''

0 likes

-

Cryomaniac

- Category 5

- Posts: 1289

- Joined: Tue Aug 15, 2006 2:26 pm

- Location: Newark, Nottinghamshire, UK

- Contact:

- HURAKAN

- Professional-Met

- Posts: 46086

- Age: 38

- Joined: Thu May 20, 2004 4:34 pm

- Location: Key West, FL

- Contact:

Re: Oil price over $106 for the first time

Gas Prices Near Records, Following Oil

By JOHN WILEN – 48 minutes ago

NEW YORK (AP) — Gasoline prices were poised Monday to set a new record at the pump, having surged to within half a cent of their record high of $3.227 a gallon. Oil prices, meanwhile, surged to $107, a new inflation-adjusted record and their fifth new high in the last six sessions on an upbeat report on wholesale inventories.

The national average price of a gallon of gas rose 0.7 cent overnight to $3.222 a gallon, 69 cents higher than one year ago, according to AAA and the Oil Price Information Service. Last May, prices peaked at $3.227 as surging demand and a string of refinery outages raised concerns about supplies.

That record will likely be left in the dust soon as gas prices accelerate toward levels that could approach $4 a gallon, though most analysts believe prices will peak below that psychologically significant mark. In its last forecast, released last month, the Energy Department said prices will likely peak around $3.40 a gallon this spring; a new forecast is due Tuesday.

Retail gas prices are following crude oil, jumped 24 percent in a month on its way to setting new inflation-adjusted records four times last week. On Monday, crude prices surged to yet another record after the Commerce Department said wholesale sales jumped by 2.7 percent in January, their biggest increase in four years, according to Dow Jones Newswires.

The strong sales report suggested to oil traders that the struggling economy may be doing better than thought.

Light, sweet crude for April delivery rose $1.55 to $106.70 on the New York Mercantile Exchange after earlier setting a new trading record of $107.

Energy investors shrugged off a relative stabilization of the dollar and a cooling in tensions between Venezuela and its neighbors Colombia and Ecuador.

Many analysts believe speculative investing attracted by the weak dollar is the primary reason oil has risen so far so fast in recent months. Crude futures offer a hedge against a falling dollar, and oil futures bought and sold in dollars are more attractive to foreign investors when the dollar is falling.

"We've got a Fed(eral Reserve) meeting on the 18th that could see a sizeable rate cut," said Brad Samples, an analyst with Summit Energy Services Inc., in Louisville, Ky. "So, it's not over."

Indeed, while the dollar fluctuated against the euro on Monday, many investors believe the greenback is likely to keep falling as the Fed continues to cut rates. Many analysts believe the rise in crude prices is not supported by the market's underlying fundamentals, noting that supplies are generally rising while demand is falling.

"By gobbling up everything in sight, (investors) are pushing food and fuel prices to ruinously high levels," said Peter Beutel, president of the energy risk management firm Cameron Hanover, in a research note.

Investors shrugged off a weekend cooling of tensions in South America, where Venezuela said Sunday it was restoring full diplomatic ties with Colombia after they were broken off following a cross-border Colombian attack on a leftist rebel camp in Ecuador.

Last week, rebels shut down a Colombian oil pipeline in retaliation for the Colombian raid into Ecuador. Venezuela threatened to slash trade and nationalize Colombian-owned businesses, and Venezuela and Ecuador briefly sent troops to their borders with Colombia.

The potential for conflict involving Venezuela, an OPEC member and major U.S. oil supplier, helped push oil higher last week.

"The Venezuelan production was at risk there," Samples said.

Other energy futures were mixed Monday. April heating oil futures rose 1.58 cents to $2.9628 a gallon while April gasoline futures fell 0.48 cent to $2.6895 a gallon.

April natural gas futures slid 4.5 cents to $9.724 per 1,000 cubic feet.

In London, Brent crude futures rose 50 cents to $102.88 a barrel on the ICE Futures exchange.

By JOHN WILEN – 48 minutes ago

NEW YORK (AP) — Gasoline prices were poised Monday to set a new record at the pump, having surged to within half a cent of their record high of $3.227 a gallon. Oil prices, meanwhile, surged to $107, a new inflation-adjusted record and their fifth new high in the last six sessions on an upbeat report on wholesale inventories.

The national average price of a gallon of gas rose 0.7 cent overnight to $3.222 a gallon, 69 cents higher than one year ago, according to AAA and the Oil Price Information Service. Last May, prices peaked at $3.227 as surging demand and a string of refinery outages raised concerns about supplies.

That record will likely be left in the dust soon as gas prices accelerate toward levels that could approach $4 a gallon, though most analysts believe prices will peak below that psychologically significant mark. In its last forecast, released last month, the Energy Department said prices will likely peak around $3.40 a gallon this spring; a new forecast is due Tuesday.

Retail gas prices are following crude oil, jumped 24 percent in a month on its way to setting new inflation-adjusted records four times last week. On Monday, crude prices surged to yet another record after the Commerce Department said wholesale sales jumped by 2.7 percent in January, their biggest increase in four years, according to Dow Jones Newswires.

The strong sales report suggested to oil traders that the struggling economy may be doing better than thought.

Light, sweet crude for April delivery rose $1.55 to $106.70 on the New York Mercantile Exchange after earlier setting a new trading record of $107.

Energy investors shrugged off a relative stabilization of the dollar and a cooling in tensions between Venezuela and its neighbors Colombia and Ecuador.

Many analysts believe speculative investing attracted by the weak dollar is the primary reason oil has risen so far so fast in recent months. Crude futures offer a hedge against a falling dollar, and oil futures bought and sold in dollars are more attractive to foreign investors when the dollar is falling.

"We've got a Fed(eral Reserve) meeting on the 18th that could see a sizeable rate cut," said Brad Samples, an analyst with Summit Energy Services Inc., in Louisville, Ky. "So, it's not over."

Indeed, while the dollar fluctuated against the euro on Monday, many investors believe the greenback is likely to keep falling as the Fed continues to cut rates. Many analysts believe the rise in crude prices is not supported by the market's underlying fundamentals, noting that supplies are generally rising while demand is falling.

"By gobbling up everything in sight, (investors) are pushing food and fuel prices to ruinously high levels," said Peter Beutel, president of the energy risk management firm Cameron Hanover, in a research note.

Investors shrugged off a weekend cooling of tensions in South America, where Venezuela said Sunday it was restoring full diplomatic ties with Colombia after they were broken off following a cross-border Colombian attack on a leftist rebel camp in Ecuador.

Last week, rebels shut down a Colombian oil pipeline in retaliation for the Colombian raid into Ecuador. Venezuela threatened to slash trade and nationalize Colombian-owned businesses, and Venezuela and Ecuador briefly sent troops to their borders with Colombia.

The potential for conflict involving Venezuela, an OPEC member and major U.S. oil supplier, helped push oil higher last week.

"The Venezuelan production was at risk there," Samples said.

Other energy futures were mixed Monday. April heating oil futures rose 1.58 cents to $2.9628 a gallon while April gasoline futures fell 0.48 cent to $2.6895 a gallon.

April natural gas futures slid 4.5 cents to $9.724 per 1,000 cubic feet.

In London, Brent crude futures rose 50 cents to $102.88 a barrel on the ICE Futures exchange.

0 likes

- HURAKAN

- Professional-Met

- Posts: 46086

- Age: 38

- Joined: Thu May 20, 2004 4:34 pm

- Location: Key West, FL

- Contact:

Re: Oil price over $107 for the first time

Oil back above 108 dollars

1 hour ago

SINGAPORE (AFP) — Oil prices were back up above 108 dollars a barrel in Asian trade Tuesday as underlying momentum remained strong because of the weak greenback and supply concerns, dealers said.

In late afternoon trade, New York's main contract, light sweet crude for April delivery gained 12 cents to 108.02 dollars a barrel from its record finish of 107.90 dollars in US trading hours Monday.

The contract had surged to a new trading high of 108.21 dollars in New York Monday as investors bet on oil prices to continue marching north on expectations the greenback would remain weak.

London's Brent North Sea crude for April delivery rose four cents to 104.20 dollars a barrel. The contract hit a trading high of 104.42 dollars Monday and closed at a new record 104.16 dollars.

OPEC's decision last week to keep its daily production levels unchanged despite pressure from the United States, the world's biggest energy user, was also lending support to the market, dealers said.

Investors are also rushing into the commodities markets, including oil, which they regard as safe havens, they said.

"There's increased nervousness about other asset classes so I think we are seeing by default, funds flowing into commodities (including oil)," said Mark Pervan, a senior commodity strategist with ANZ bank in Melbourne.

"It is really seen as a safe haven at the moment so there is a lot of momentum which can continue to push prices higher," he said.

Meanwhile, US President George W. Bush's administration has signaled that Vice President Dick Cheney personally would urge OPEC kingpin Saudi Arabia to convince the cartel to boost output.

Cheney is expected to raise the issue of soaring oil prices with Saudi Arabia on his trip to the Middle East next week.

"I'm sure that energy issues will come up," White House spokeswoman Dana Perino said. "Obviously we want to see an increase in production."

The US economy is seen as the worst hit if oil prices continue to skyrocket because of its heavy dependence on imported oil and the weak greenback exacerbates the situation, dealers said.

"The US market is really feeling the pinch," said Pervan. "One is slowing growth and they bear the full brunt of high prices in terms of US dollars."

The weak US currency, which fell to a new low of 1.5464 against the euro last week, encourages demand for dollar-priced commodities like oil because it makes them cheaper for buyers using other currencies.

In afternoon Asian trading, the euro traded around 1.5362 dollars.

1 hour ago

SINGAPORE (AFP) — Oil prices were back up above 108 dollars a barrel in Asian trade Tuesday as underlying momentum remained strong because of the weak greenback and supply concerns, dealers said.

In late afternoon trade, New York's main contract, light sweet crude for April delivery gained 12 cents to 108.02 dollars a barrel from its record finish of 107.90 dollars in US trading hours Monday.

The contract had surged to a new trading high of 108.21 dollars in New York Monday as investors bet on oil prices to continue marching north on expectations the greenback would remain weak.

London's Brent North Sea crude for April delivery rose four cents to 104.20 dollars a barrel. The contract hit a trading high of 104.42 dollars Monday and closed at a new record 104.16 dollars.

OPEC's decision last week to keep its daily production levels unchanged despite pressure from the United States, the world's biggest energy user, was also lending support to the market, dealers said.

Investors are also rushing into the commodities markets, including oil, which they regard as safe havens, they said.

"There's increased nervousness about other asset classes so I think we are seeing by default, funds flowing into commodities (including oil)," said Mark Pervan, a senior commodity strategist with ANZ bank in Melbourne.

"It is really seen as a safe haven at the moment so there is a lot of momentum which can continue to push prices higher," he said.

Meanwhile, US President George W. Bush's administration has signaled that Vice President Dick Cheney personally would urge OPEC kingpin Saudi Arabia to convince the cartel to boost output.

Cheney is expected to raise the issue of soaring oil prices with Saudi Arabia on his trip to the Middle East next week.

"I'm sure that energy issues will come up," White House spokeswoman Dana Perino said. "Obviously we want to see an increase in production."

The US economy is seen as the worst hit if oil prices continue to skyrocket because of its heavy dependence on imported oil and the weak greenback exacerbates the situation, dealers said.

"The US market is really feeling the pinch," said Pervan. "One is slowing growth and they bear the full brunt of high prices in terms of US dollars."

The weak US currency, which fell to a new low of 1.5464 against the euro last week, encourages demand for dollar-priced commodities like oil because it makes them cheaper for buyers using other currencies.

In afternoon Asian trading, the euro traded around 1.5362 dollars.

0 likes

-

Cryomaniac

- Category 5

- Posts: 1289

- Joined: Tue Aug 15, 2006 2:26 pm

- Location: Newark, Nottinghamshire, UK

- Contact:

- TexasStooge

- Category 5

- Posts: 38127

- Joined: Tue Mar 25, 2003 1:22 pm

- Location: Irving (Dallas County), TX

- Contact:

"This president would not use the Strategic Petroleum Reserve (SPR) to manipulate prices unless there was a true emergency,"

In a press conference GW said he had not heard that gasoline prices might reach $4 a gallon. In order for him to be confident making that claim he must have been briefed about higher interest rates or a collapse in demand. Of course then I remember the incident when Reagan thought supermarket checkout scanners were something new

In a press conference GW said he had not heard that gasoline prices might reach $4 a gallon. In order for him to be confident making that claim he must have been briefed about higher interest rates or a collapse in demand. Of course then I remember the incident when Reagan thought supermarket checkout scanners were something new

0 likes

-

Ed Mahmoud

Re:

TexasStooge wrote:I hate to say this, but I smell more money pocketed for the CEOs.

1) I suspect this thread will get a new name 3 or 4 times a week for a while.

2) I don't think the numbers have changed much since last year, big oil companies make about eight cents a gallon profit. The Feds charge more in taxes. The people getting rich are the oil sheikhs. Companies heavily into crude production are doing ok, those companies, like Valero, which used to be Diamond Shamrock, and decided back during $10 oil there was no future in oil production, and spun off their offshore drilling company, Diamond Offshore, and their oil company (later bought by an Argentian firm, that was then purchased by a Spanish oil company) and are now strictly refining and marketing, are doing a little worse, as gasoline prices have been lagging oil prices a little bit.

Now, Hugo Chavez would really be getting rich, but since he purged the leadership of the state oil company, PDVSA, and replaced them with loyalists, and has started running foreign companies out of the country, he needs the higher prices just to break even with falling output.

I know everyone hates Exxon-Mobil, because they are reporting record revenues, but a whole lot of teacher retirement funds, 401ks and the such own their stock, and when you get upset over the price of gasoline, remember 1) a big part is due to a weakening dollar and 2) think of the margins Coca-Cola and Pepsi are making selling a product that cost a few dimes a gallon to produce.

0 likes

- feederband

- S2K Supporter

- Posts: 3423

- Joined: Wed Oct 01, 2003 6:21 pm

- Location: Lakeland Fl

Re: Re:

Ed Mahmoud wrote:[2) think of the margins Coca-Cola and Pepsi are making selling a product that cost a few dimes a gallon to produce.

Alluminum and transportation cost have killed that margin...When soda is on sale...That supermarket is taking a huge loss on that product...

0 likes

-

Ed Mahmoud

Re:

HURAKAN wrote:I don't want to think what will happen as we get to the summer months and the Atlantic hurricane season gets going.

Well, if my not strongly supported (ie, somewhat lacking in science) belief that the 1949-1950 winter analog continues into the summer (and so far, it has sort of worked for Joe Bastardi), then while Florida, both Peninsula and Panhandle get smacked, New Orleans to Brownsville, where most of the offshore platforms and refining capacity on the Gulf Coast are, will be completely untouched.

0 likes

Re: Oil price over $109 for the first time

I just do not know how people can pay these high prices!!!!???????I have to take money from our "grocery money" to put gas in the car to make it to work now.I might have to take a car off our insurance so I can save money for food.Last month cost me $475 for total gas.Grocery was only $300!!!!Also one other thing to think about is every summer they add that "Summer blend" which is suppose to add another .20 to a gallon.

0 likes

- HURAKAN

- Professional-Met

- Posts: 46086

- Age: 38

- Joined: Thu May 20, 2004 4:34 pm

- Location: Key West, FL

- Contact:

Re: Oil price over $109 for the first time

Oil Above $110, Close to Record

By GILLIAN WONG – 1 hour ago

SINGAPORE (AP) — Oil prices on Thursday were near an overnight record above $110 a barrel as investors looked to commodities as a safe haven against the U.S. dollar's slide.

In Asia, the dollar sank to a 12-year low against the yen and hit a record low against the euro amid concerns about the flagging U.S. economy. Many analysts believe the greenback's decline is the reason crude futures have surged to new records in 11 of the past 12 sessions, despite the fact that crude supplies have risen 10.2 percent since early January.

Crude futures offer a hedge against a falling dollar, and oil futures bought and sold in dollars are more attractive to foreign investors when the dollar is weak.

"Oil and other commodities have an intrinsic value so that to the extent that the U.S. dollar depreciates, (oil) becomes relatively cheaper in terms of other currencies, such as the euro," said David Moore, a commodity strategist with the Commonwealth Bank of Australia in Sydney. "So you get an adjustment to compensate for that effect."

Light, sweet crude for April delivery rose 21 cents to $110.13 a barrel in electronic trading on the New York Mercantile Exchange by late afternoon in Singapore, holding just below Wednesday's record trading high of $110.20 a barrel.

Oil prices initially fell Wednesday in New York trading after the U.S. Energy Department's Energy Information Administration, or EIA, said crude supplies rose 6.2 million barrels last week, more than three times the 1.6 million barrels forecast by analysts surveyed by Dow Jones Newswires. But buyers quickly returned to the market.

"We did see oil prices take a bit of a hit when the EIA data was released ... but obviously that dent was only temporary," Moore said. "Subsequently, oil prices went up higher again, and I think the weakness of the U.S. dollar was a key part of that."

The EIA also reported that gasoline supplies rose 1.7 million barrels last week, well above the expected 300,000 barrel increase, and distillate supplies dropped 1.2 million barrels, less than the expected 2 million barrel decline.

It was the eighth increase in crude supplies in nine weeks, putting oil inventories back on a growth track after a one-week decline. Meanwhile, forecasters including the Energy Department, the International Energy Agency and OPEC have consistently reduced their demand growth predictions for this year.

Wednesday's EIA report offered more evidence demand is falling: Gasoline consumption fell 0.7 percent last week compared to the same week last year. Normally, gasoline consumption grows about 1.5 percent year-over-year, just to keep pace with population growth.

Many analysts argue that current oil prices can't be justified by the market's underlying supply and demand fundamentals. Yet evidence of weak demand amid growing supplies has not stopped oil prices from rising in the past, particularly when the dollar is falling.

"Some investors are apparently viewing oil and other commodities as providing something of a hedge against U.S. dollar weakness and possibly inflation concerns as well," Moore said.

In other Nymex trading, heating oil futures lost 0.19 cent to $3.0225 a gallon while gasoline prices were down 0.31 cent to $2.7255 a gallon. Natural gas futures added 6.2 cents to $10.073 per 1,000 cubic feet.

In London, Brent crude futures fell 18 cents to $106.09 a barrel on the ICE Futures exchange.

By GILLIAN WONG – 1 hour ago

SINGAPORE (AP) — Oil prices on Thursday were near an overnight record above $110 a barrel as investors looked to commodities as a safe haven against the U.S. dollar's slide.

In Asia, the dollar sank to a 12-year low against the yen and hit a record low against the euro amid concerns about the flagging U.S. economy. Many analysts believe the greenback's decline is the reason crude futures have surged to new records in 11 of the past 12 sessions, despite the fact that crude supplies have risen 10.2 percent since early January.

Crude futures offer a hedge against a falling dollar, and oil futures bought and sold in dollars are more attractive to foreign investors when the dollar is weak.

"Oil and other commodities have an intrinsic value so that to the extent that the U.S. dollar depreciates, (oil) becomes relatively cheaper in terms of other currencies, such as the euro," said David Moore, a commodity strategist with the Commonwealth Bank of Australia in Sydney. "So you get an adjustment to compensate for that effect."

Light, sweet crude for April delivery rose 21 cents to $110.13 a barrel in electronic trading on the New York Mercantile Exchange by late afternoon in Singapore, holding just below Wednesday's record trading high of $110.20 a barrel.

Oil prices initially fell Wednesday in New York trading after the U.S. Energy Department's Energy Information Administration, or EIA, said crude supplies rose 6.2 million barrels last week, more than three times the 1.6 million barrels forecast by analysts surveyed by Dow Jones Newswires. But buyers quickly returned to the market.

"We did see oil prices take a bit of a hit when the EIA data was released ... but obviously that dent was only temporary," Moore said. "Subsequently, oil prices went up higher again, and I think the weakness of the U.S. dollar was a key part of that."

The EIA also reported that gasoline supplies rose 1.7 million barrels last week, well above the expected 300,000 barrel increase, and distillate supplies dropped 1.2 million barrels, less than the expected 2 million barrel decline.

It was the eighth increase in crude supplies in nine weeks, putting oil inventories back on a growth track after a one-week decline. Meanwhile, forecasters including the Energy Department, the International Energy Agency and OPEC have consistently reduced their demand growth predictions for this year.

Wednesday's EIA report offered more evidence demand is falling: Gasoline consumption fell 0.7 percent last week compared to the same week last year. Normally, gasoline consumption grows about 1.5 percent year-over-year, just to keep pace with population growth.

Many analysts argue that current oil prices can't be justified by the market's underlying supply and demand fundamentals. Yet evidence of weak demand amid growing supplies has not stopped oil prices from rising in the past, particularly when the dollar is falling.

"Some investors are apparently viewing oil and other commodities as providing something of a hedge against U.S. dollar weakness and possibly inflation concerns as well," Moore said.

In other Nymex trading, heating oil futures lost 0.19 cent to $3.0225 a gallon while gasoline prices were down 0.31 cent to $2.7255 a gallon. Natural gas futures added 6.2 cents to $10.073 per 1,000 cubic feet.

In London, Brent crude futures fell 18 cents to $106.09 a barrel on the ICE Futures exchange.

0 likes

Re: Oil price over $110 for the first time

I'm going back to taking the bus to work until the weather is nice enough to bike it.

0 likes

- HURAKAN

- Professional-Met

- Posts: 46086

- Age: 38

- Joined: Thu May 20, 2004 4:34 pm

- Location: Key West, FL

- Contact:

Re: Oil price over $110 for the first time

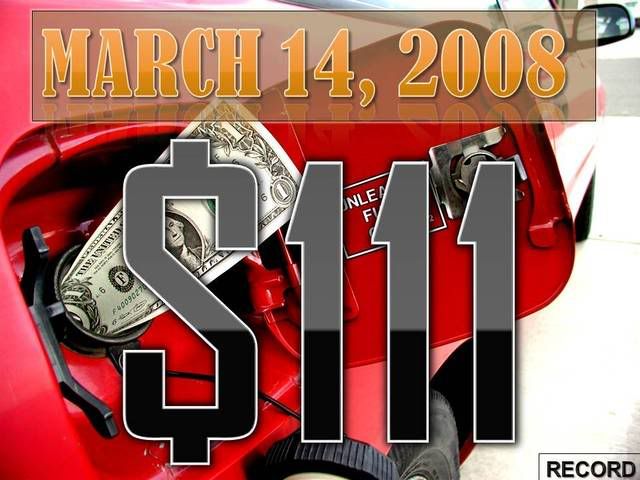

Oil hits record $US111, US dollar dives

From correspondents in New York

March 15, 2008 09:01am

OIL prices held near all-time highs today, capping a tumultuous week of surging prices attributed to a sliding dollar and choppy world stock markets.

New York's main oil contract, light sweet crude for delivery in April, shed 12 cents to close at $US110.21 per barrel a day after hitting a fresh intraday record of $US111.

”The (US) dollar sentiment remains negative,'' said Sucden analyst Andrey Kryuchenkov.

”Dollar-denominated commodities are still well-supported by the weaker Greenback, making them relatively cheaper for foreign investors.''

Alaron Trading analyst Phil Flynn highlighted the impact of the credit crisis.

”This situation with the US dollar is a direct result of the fallout of the liquidity crisis and its impact on the world's perception of the US economy,'' Mr Flynn said.

”The US Federal Reserve has cut rates aggressive and that has added to the US dollar's woes and in my estimation has been directly responsible for adding at least 20 or 30 dollars to the price of oil. Oil prices are treading in dangerous territory as oil and gasoline are being played more as a hedge against the dollar and has little regard for supply and demand.''

The euro hit a record high $US1.5688 overnight amid growing US recession fears.

World share prices have been rocked by persistent concerns that the US sub-prime, or high-risk, home loan crisis and subsequent credit squeeze could herald a global economic slowdown.

Sentiment was battered afresh yesterday as news emerged that a troubled investment fund backed by US private equity giant Carlyle had failed.

Another dose of bad news came today when US investment giant Bear Stearns had to get emergency funding from JPMorgan Chase in coordination with the US Federal Reserve Bank of New York.

The development sent Wall Street into a tailspin amid growing fears of a US recession, analysts said.

Investors also turned to commodities for shelter from risks of higher inflation, which also sent gold prices above $US1,000 per ounce for the first time this week.

”Energy markets continue to enjoy their status as an alternative 'safe haven' for those fleeing the ravaged bond and stock markets,'' said MF Global analyst Ed Meir.

”With the sinking US dollar providing support, the path of least resistance seems to be higher still.''

Oil prices have rocketed by 90 per cent over the past year as the market was driven by tight supplies, geopolitical concerns in key producer nations and fierce demand for crude from China and India.

Prices have gained about 9 per cent in value since the start of 2008, accelerating after the OPEC crude exporters' cartel held output at current levels last week.

From correspondents in New York

March 15, 2008 09:01am

OIL prices held near all-time highs today, capping a tumultuous week of surging prices attributed to a sliding dollar and choppy world stock markets.

New York's main oil contract, light sweet crude for delivery in April, shed 12 cents to close at $US110.21 per barrel a day after hitting a fresh intraday record of $US111.

”The (US) dollar sentiment remains negative,'' said Sucden analyst Andrey Kryuchenkov.

”Dollar-denominated commodities are still well-supported by the weaker Greenback, making them relatively cheaper for foreign investors.''

Alaron Trading analyst Phil Flynn highlighted the impact of the credit crisis.

”This situation with the US dollar is a direct result of the fallout of the liquidity crisis and its impact on the world's perception of the US economy,'' Mr Flynn said.

”The US Federal Reserve has cut rates aggressive and that has added to the US dollar's woes and in my estimation has been directly responsible for adding at least 20 or 30 dollars to the price of oil. Oil prices are treading in dangerous territory as oil and gasoline are being played more as a hedge against the dollar and has little regard for supply and demand.''

The euro hit a record high $US1.5688 overnight amid growing US recession fears.

World share prices have been rocked by persistent concerns that the US sub-prime, or high-risk, home loan crisis and subsequent credit squeeze could herald a global economic slowdown.

Sentiment was battered afresh yesterday as news emerged that a troubled investment fund backed by US private equity giant Carlyle had failed.

Another dose of bad news came today when US investment giant Bear Stearns had to get emergency funding from JPMorgan Chase in coordination with the US Federal Reserve Bank of New York.

The development sent Wall Street into a tailspin amid growing fears of a US recession, analysts said.

Investors also turned to commodities for shelter from risks of higher inflation, which also sent gold prices above $US1,000 per ounce for the first time this week.

”Energy markets continue to enjoy their status as an alternative 'safe haven' for those fleeing the ravaged bond and stock markets,'' said MF Global analyst Ed Meir.

”With the sinking US dollar providing support, the path of least resistance seems to be higher still.''

Oil prices have rocketed by 90 per cent over the past year as the market was driven by tight supplies, geopolitical concerns in key producer nations and fierce demand for crude from China and India.

Prices have gained about 9 per cent in value since the start of 2008, accelerating after the OPEC crude exporters' cartel held output at current levels last week.

0 likes

-

Rainband

Re: Oil price over $111 for the first time

The US dollar index has dropped from 82 down to 71 in just a few months. The federal reserve keeps having to lower interest rates to keep the banks afloat and that kills the currency.

The bank situation is worse than is being reported in the media, some banks are beginning to have cash flow problems in day to day operations.

http://tinyurl.com/377tcl

This Tuesday March 18th the Federal Reserve will be lowering interest rates again so the US dollar will continue to sink. The inflation numbers for February were reported lower than expected which was an obvious signal for a rate drop. Its almost a sure thing the Feb inflation will be revised back upward when the March numbers come out in April. By then oil could be $120 a barrel. A 10 percent increase from current levels in oil prices is perceived as less of a threat than the bank crisis.

The bank situation is worse than is being reported in the media, some banks are beginning to have cash flow problems in day to day operations.

http://tinyurl.com/377tcl

This Tuesday March 18th the Federal Reserve will be lowering interest rates again so the US dollar will continue to sink. The inflation numbers for February were reported lower than expected which was an obvious signal for a rate drop. Its almost a sure thing the Feb inflation will be revised back upward when the March numbers come out in April. By then oil could be $120 a barrel. A 10 percent increase from current levels in oil prices is perceived as less of a threat than the bank crisis.

0 likes

Who is online

Users browsing this forum: No registered users and 144 guests